Data

Comprehensive data on a wide variety of financial products

Quantalys provide Data Management and Financial Data to numerous financial instituitions and media.

Our prioritary database encompasses +150,000 share classes and +800 life insurance products .

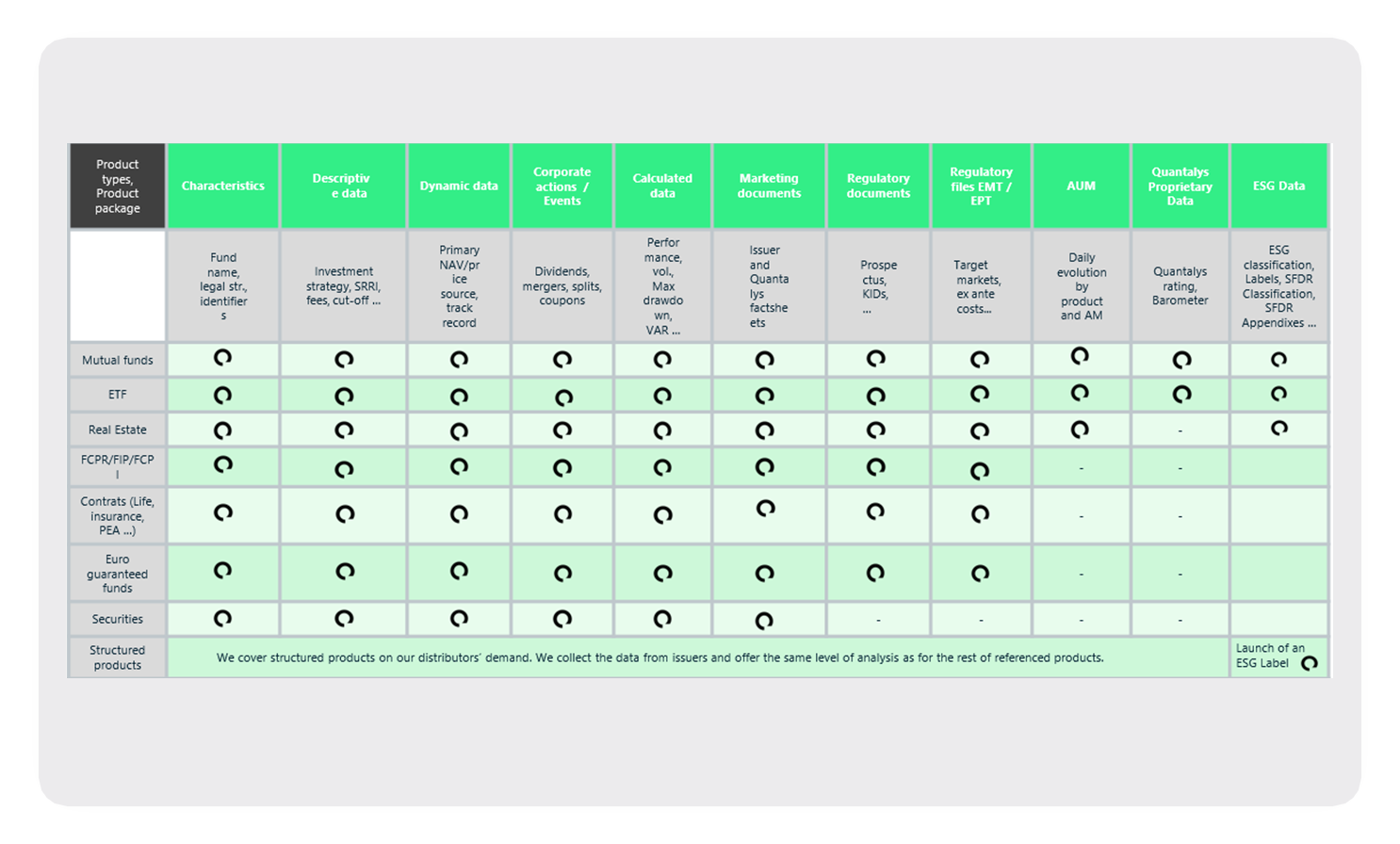

Funds

Powered by + 1,500 distincts sources our proprietary database is for back, middle and front offices' uses.

It covers several financial supports: Funds, ETFs, Life Insurance Products, REITs, Private Equity Funds, Structured Products, etc.

Our data experts collect, check and calculate +800 data points from NAV, static & dynamic data, Quantalys Rating, to regulatory documents, european templates (EPT, EMT, EET) and dealing data (corporate actions, calendar settlement, etc.)

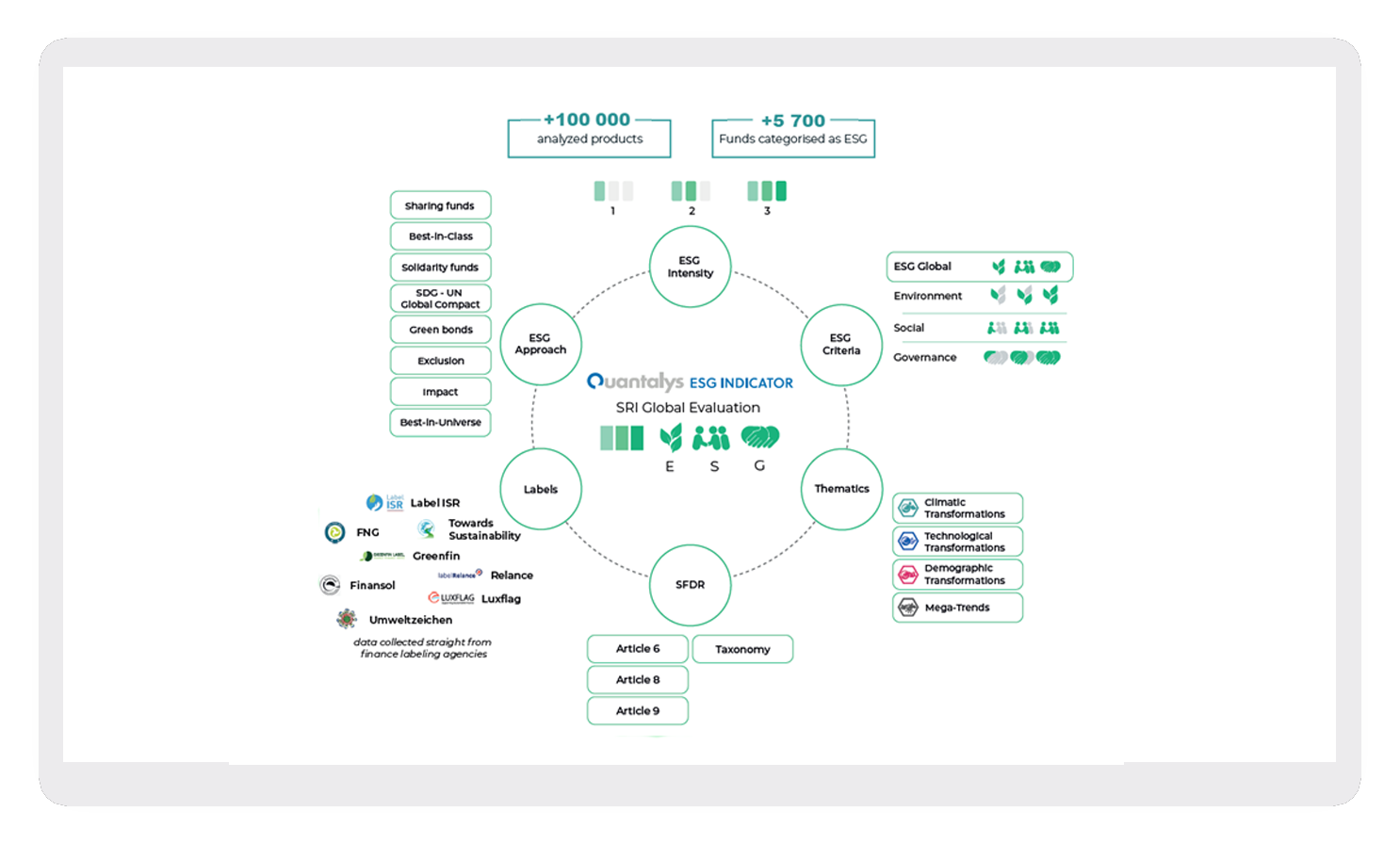

ESG dimension

Since 2019, we are committed to addressing the ESG dimension by covering complete and reliable data with our Quantalys ESG indicator:

- Quantalys ESG Intensity,

- SFDR Classification,

- Labels,

- Thematic Categories,

- SFDR Disclosures, etc.

We collect raw EETs and are able to generate structured EETs / other data issued from them according your consolidation rules.

Delivery options

Based on your needs, data is accessible through a variety of channels:

- SFTP

- API

- SaaS solutions

- Tailor-made solutions (can be integrated into your IS)

- Add-in excel (available through our SaaS solutions)

As a complement to our data services, we provide with tailor-made alert / monitoring files based on the scope concerned.

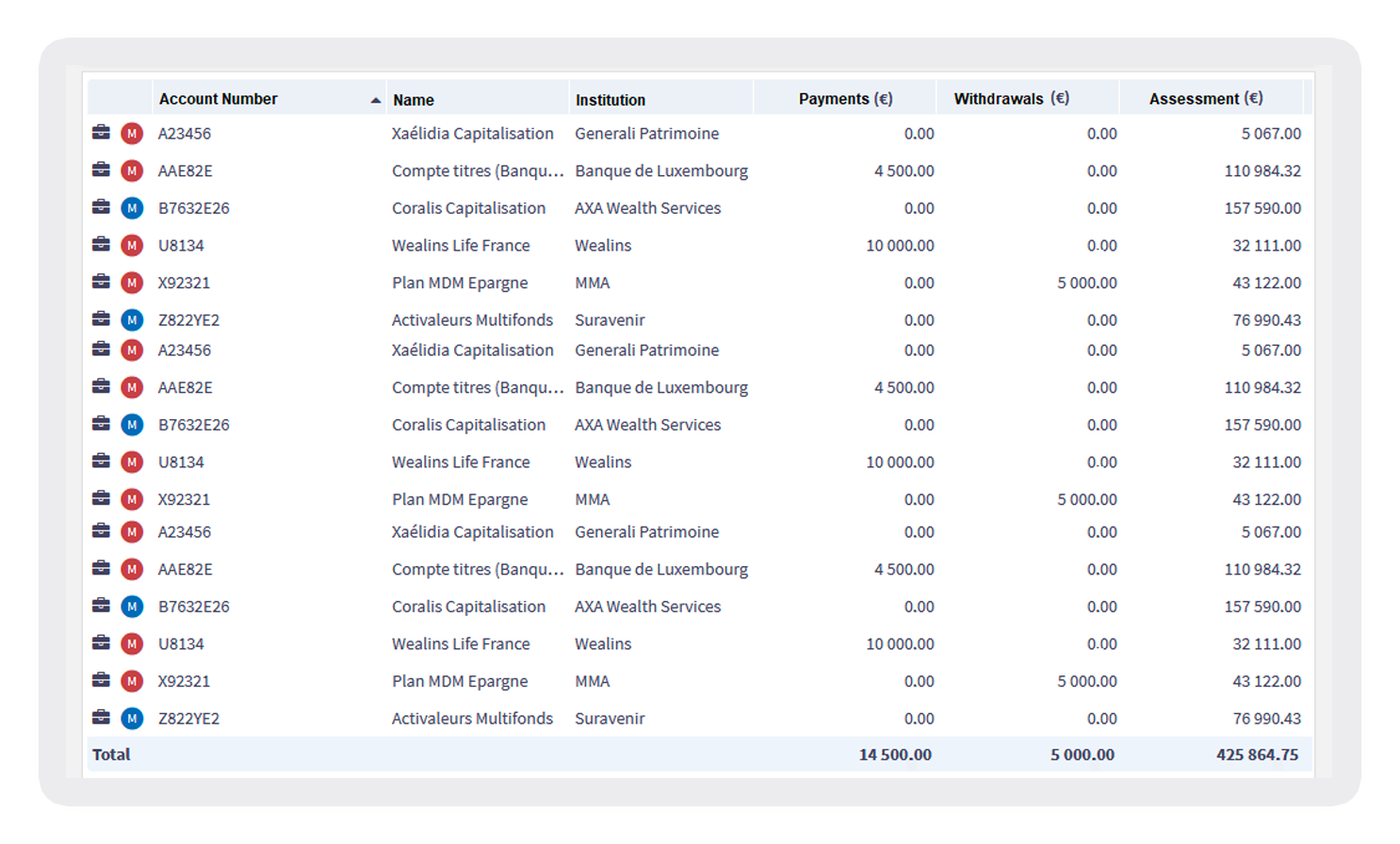

Aggregation

In addition with the Quantalys fund data service, the Harvest Group offers the aggregation service.

With this service get a reliable consolidation of your financial assets through the unified restitution in a structured data exchange format, the standard of the PENELOP association of which Harvest is a member, guaranteeing the completeness and quality of your flows

More than 150 aggregation sources are available to you

Retrieve your unified data, enrich your portfolios with the latest updated repositories, to use them in your information systems

Import the latest valuation of your portfolios from your suppliers on a daily basis, and consolidate the situations and movements of all your contracts

Categorise contract products and process complex financial products (Internal Dedicated Funds, equity derivatives, structured products, etc.)